If you’ve worked in the healthcare industry for a long time, you know that the last 15 years have been transformative for employee benefits. We’ve moved well beyond basic medical, dental and vision offerings to provide beneficiaries with a complete set of resources that cater to their holistic well-being—from mental health tools and retirement guidance to childcare subsidies and pet insurance.

But there’s one area where we still haven’t caught up with modern times: Medicare. We recently surveyed over 1,000 seniors aged 65 or older and found that the Medicare experience has only become more confusing and complicated for the folks that use it. While technology has come a long way in improving the employee benefits journey overall, seniors are still stuck in decades-old systems, and are targeted by the same old communication strategies we were using decades ago.

That means Medicare beneficiaries are left in the dark, and might not fully understand the enrollment process or the value of the plans they’re choosing. Worse yet? They’re not taking full advantage of their Medicare benefits—which means your efforts are going to waste. (Wah wah.)

And it’s not that beneficiaries are dreading the whole idea of Medicare overall! For many, they’re excited by the prospect of approaching retirement, and are thrilled to be eligible. But they’re distrustful—and misinformed—about the process.

Let’s take a look at why today’s Medicare experience isn’t working, and what benefits professionals like you can do to fix it.

TL;DR

Today’s seniors don’t look like yesterday’s seniors.

- By 2035, 16% of the workforce will be 70 or above.

The Medicare experience is broken.

- 2 in 5 say Medicare is overwhelming and confusing.

Beneficiaries don’t know who to trust.

- 1 in 3 do not have a trusted, unbiased source for Medicare information.

It doesn’t get better after enrollment.

- 1 in 4 aren’t confident they know how to use their plan effectively.

A better way forward: Meet ALEX Medicare.

- 52% want to learn about Medicare through an unbiased, personalized digital experience.

Today’s seniors don’t look like yesterday’s seniors

Why is the Medicare process so confusing for today’s seniors? Put simply, our old methods no longer match our current audience.

Aging in the US has changed significantly over the past few decades. People are living longer, which means they’re staying at work longer too.

And it’s not just about pushing off retirement—today’s seniors are healthier, more tech-savvy, and have different priorities than their older counterparts. Let’s take a look at a 65-year-old in the ‘90s versus today.

1990s senior

Health & Wellness

- Regular doctor visits

- Basic medications

- Some preventive screenings

Work & Retirement

- Pensions, savings, & social security

- Traditional investments

- Only 12% still working

Social Life

- Church communities

- Local clubs & organizations

- Phone calls & letters

Leisure

- Gardening, reading,

- VHS tapes, CDs, & cable TV

- Occasional travel

Technology

- Landline telephones

- Personal computers not yet prevalent

- Internet use was limited

2024 senior

Health & Wellness

- Exercise & staying active

- Balanced nutrition

- Preventative Healthcare

Work & Retirement

- Actively engaged in the workforce

- 20% still working

Social Life

- Clubs, volunteer work, & online social networks

- Video calls & emails with family & friends

Leisure

- Greater diversity in lifestyle choices

- Travel, hobbies, & lifelong learning

Technology

- Comfortable with technology

- Smartphones, computers, & social media

Today, Medicare-eligible folks look, feel, and act younger than ever. They communicate via text, learn about their benefits online, and take more ownership over their health than past generations did.

So if we’re still relying on old stereotypes about how aging folks don’t understand technology, or have accepted that their personal health is declining…we’re about 20 years behind. Our Medicare education, enrollment and engagement strategies still support that ‘90s senior, when we should be focused on creating experiences that appeal to modern needs, wants and lifestyles.

And if we’re not catering to today’s tech-savvy, health-conscious beneficiaries, then we certainly aren’t prepared for the digital-first generations that are right behind them, who will need Medicare guidance sooner than we might think.

The Medicare experience is broken

Where have we gone wrong when it comes to educating Medicare-eligible folks about their options? Let’s start with how we’re making beneficiaries feel.

When asked what word comes to mind when they think about enrolling in Medicare coverage, many survey respondents felt negatively—using words like “complicated” and “expensive.” And 40% agreed that the Medicare process overall is overwhelming and confusing.

When you think about enrolling in Medicare coverage, what is the first word that comes to mind?

That’s no surprise, considering that the average beneficiary has access to 43 different Medicare Advantage plans alone. Without the right guidance, it’s simply too challenging to sort through the options and decide which plan will offer the right coverage at the right cost—especially for first-time enrollees.

Additionally, only about half of our survey respondents said that they feel positively about the Medicare enrollment process:

While that’s a good start, we still leave 45% of Medicare-eligible folks in the dust. And that number is significant when you consider that 62.3 million Americans use Medicare every year—in other words, 28 million Medicare users likely feel negatively about the enrollment process.

Beneficiaries don’t know who to trust

Where’s all that confusion coming from? Our research reveals that when it comes to learning about Medicare, beneficiaries don’t know who they can trust to give them accurate and personally helpful information.

You’ve seen the headlines: Medicare scams are on the rise, and beneficiaries are bombarded with a sea of misinformation and conflicting messages from a variety of well-meaning (and not-so-well-meaning) sources.

Thanks to all that conflicting information, Medicare-eligible folks are skeptical about the messages they receive—and they’re not sure they can trust the “experts” they’re speaking with to guide them toward the right plans for them:

And can you blame them for raising an eyebrow or two? Trusted sources are harder to come by than they should be:

That means beneficiaries are left to their own devices and are seeking out information on their own. Many are turning to a friend or family member to help them make a decision, and the top way people would prefer to learn about Medicare is online through their own research—which makes sense when trust in the current system is so low.

How would you prefer to learn about Medicare eligibility, coverage and plan options?

While we can certainly applaud their efforts to become Medicare experts themselves, self-education doesn’t leave beneficiaries with the tools they need to make the best possible healthcare decisions.

It doesn’t get better after enrollment

Unfortunately, things don’t get any easier after beneficiaries wade through the muddy waters of Medicare enrollment. While 76% of respondents told us they were confident in their selections at the time of enrollment (great news!), those feelings quickly deteriorated as they started using their healthcare plans.

As a result, nearly 40% of folks say they’re not sure about their next steps or are definitely planning to switch Medicare plans:

Are you considering switching Medicare plans during the next Annual Enrollment Period?

Red alert! 🚨

That uncertainty comes at a BIG cost to you. When beneficiaries aren’t satisfied with their plans or the service they’re receiving, your CMS star ratings are affected. And that means lower profits:

A better way forward: Meet ALEX Medicare

Acknowledging the problem is the first step to healing. But how can we truly move forward, with a modern solution that better educates Medicare beneficiaries once and for all?

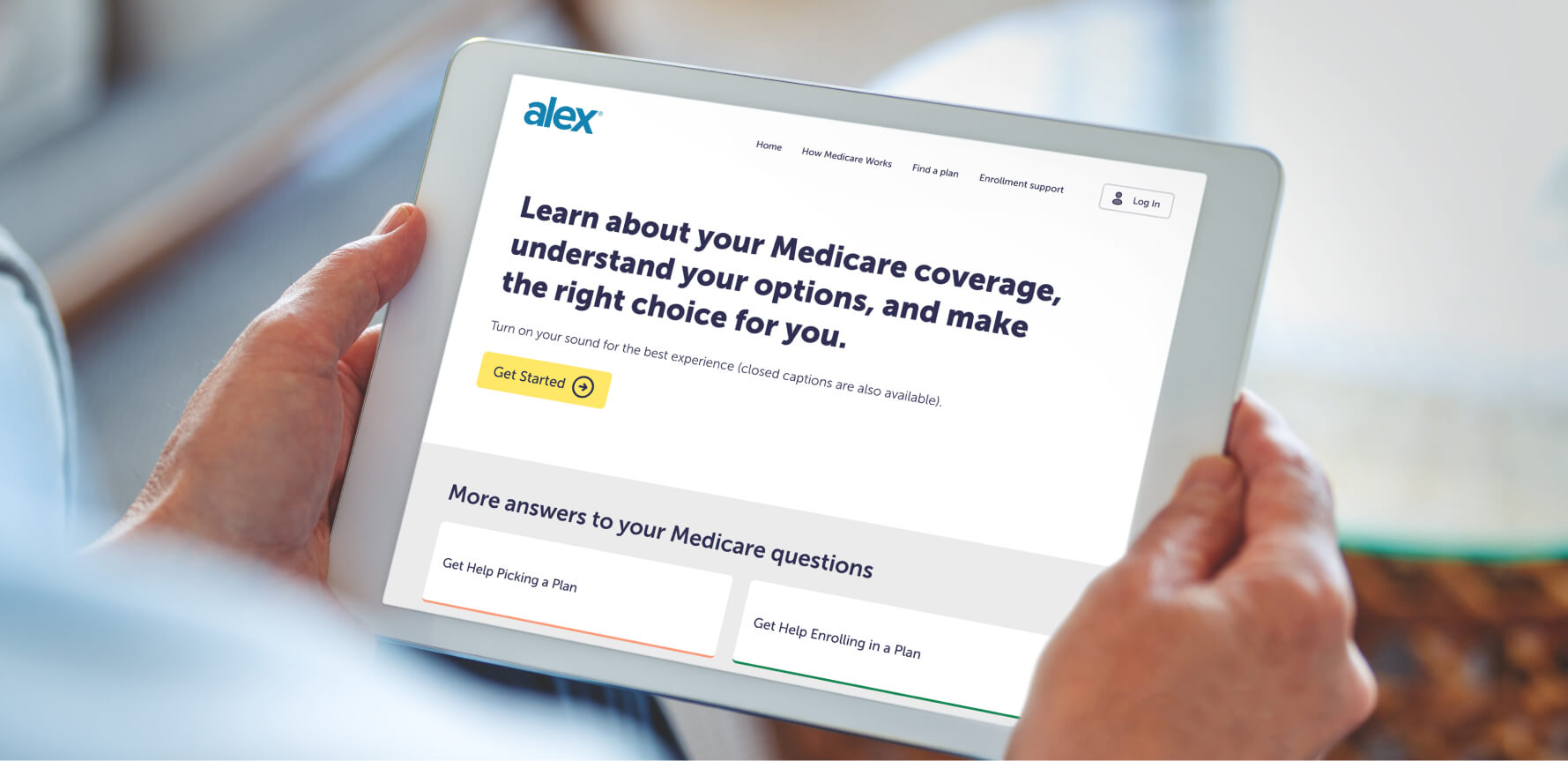

Meet ALEX Medicare: an unbiased, tech-first platform that helps beneficiaries navigate all the parts, plans, and endless coverage options—guiding them toward smarter, more empowered choices. Here’s how ALEX supports your efforts:

Combat trust issues

Put that phone down! Medicare beneficiaries are doing their own research, and want a primer on their options before they ever talk to a salesperson. ALEX Medicare educates beneficiaries on their own time, with an online library of resources and one-on-one conversations with a trusted guide.

All you have to do is email your prospects a link—before you ever even speak with them!

Prevent churn

Poor star ratings = lost money for you. When beneficiaries are dissatisfied with their plans, they’re more likely to leave you behind and look for solutions elsewhere. And that’s why it’s so important to invest in additional education upfront.

ALEX Medicare offers beneficiaries a scalable, digital-first way to understand their plan and how to use it right from the start—so that they’ll stick with it (and with you).

Modernize the Medicare experience

Lastly (and perhaps most importantly), ALEX Medicare is simply the experience that beneficiaries want and need.

Methodology

Jellyvision performed a quantitative survey of over 1,000 individuals in June 2024 via SurveyMonkey. 97% of respondents were 65 years or older, and 88% are currently enrolled in Medicare. 75% of respondents are retired, while others were employed full- or part-time. 65% of respondents were female, and 35% were male. All survey participants are based in the U.S.