When it comes to healthcare, you get what you pay for. Yes, it’s nice to have the lowest possible monthly premiums, deductibles, and copays—but when you have a health crisis and your plan doesn’t cover the medical services you need? All that penny-pinching goes to waste.

Choosing a healthcare plan is all about finding a balance between cost and coverage. But that task is a lot easier said than done. With so many options to choose from and confusing jargon at every turn, figuring out how to spend less while securing the right level of care can feel like an endless maze.

So how do we relieve that tension, and make it easier for employees to choose the right coverage at the right cost? Luckily, new technology has emerged to solve this very problem, in the form of predictive analytics.

But what is predictive analytics, and how is it simplifying the benefits puzzle? Let’s jump in.

What is predictive analytics?

Predictive analytics uses historical data and machine learning to identify how likely it is that a future event will happen. By analyzing historical information, predictive analytics algorithms can spot patterns and trends, giving end users a better idea of how a given scenario will play out.

These days, it seems like predictive analytics is everywhere. This type of technology can be applied to an endless number of fields, like marketing, finance, retail or sports.

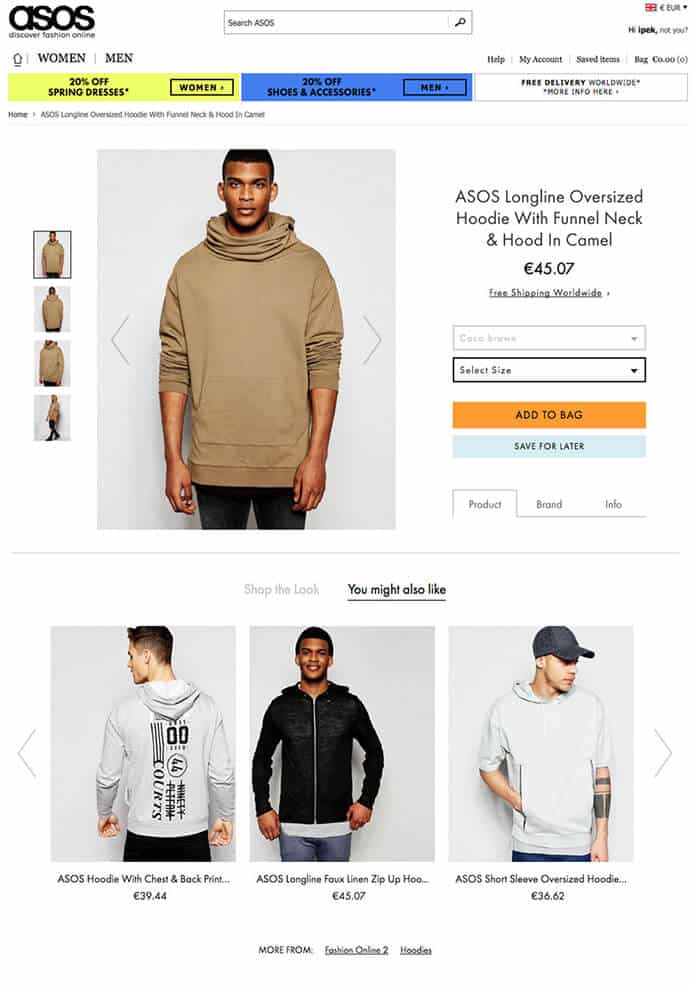

In fact, if you’re an online shopper, you probably encounter predictive analytics every day without even realizing it. Remember the “Customers also like…” sections on e-commerce sites? That’s right, it’s predictive analytics at work—assessing your shopping behavior, comparing it to other shoppers like you, and outputting recommendations for other products to buy.

To implement predictive analytics, data is first collected from various sources, like customer transactions, social media activity, or medical records. This data is then processed and analyzed using machine learning algorithms to identify patterns and trends. Once the predictive model is developed, it can be used to make predictions about future events based on new data.

Predictive analytics has proven to be a powerful tool in decision-making, enabling organizations and individuals to make more informed choices.

What is predictive analytics in healthcare and employee benefits?

Within the past decade, the healthcare industry has increasingly applied predictive analytics to a variety of problems, with the goal of improving patient outcomes, reducing costs, and optimizing how resources are used.

For example, predictive models can be used to identify patients at risk of developing certain conditions, predict hospital readmission, and inform personalized treatment plans.

In other cases, predictive analytics can be used to decide where healthcare resources should be allocated. For example, healthcare professionals can forecast patient demand, identify bottlenecks in the supply chain, and optimize staffing schedules to improve efficiency and reduce costs.

And in our world of employee benefits, predictive analytics has revolutionized how we connect employees with the healthcare plans that are best for them specifically. Making healthcare decisions is incredibly complicated and includes endless factors—from cost and coverage to finding in-network providers and deciphering medical lingo. And while we can’t give employees a Magic 8 ball to flawlessly forecast their healthcare journey, we can give them the right technology—in the form of predictive analytics—to help ease those decisions. (More on that in the next section!)

How are we using predictive analytics to make ALEX smarter?

Fifteen years ago, our team at Jellyvision set out to reimagine how employees choose their benefits by launching a platform called ALEX. Since then, ALEX has helped millions of employees learn about, choose and use the resources their employers provide them, through human, one-on-one conversations.

But since then, our health systems have only become more complicated. Employers are expanding their benefits packages to attract and retain talent. Non-traditional benefits are taking the spotlight as holistic health becomes a priority. And health equity is centerstage as employers look for ways to meet the diverse needs of their workforces.

In other words, it’s never been harder to connect employees with the right benefits, at the right times, in the right places.

That’s why we acquired Picwell: a benefits decision support company backed by predictive analytics that will launch ALEX into the next era of employee benefits engagement.

Predictive analytics + ALEX: a match made in HR heaven

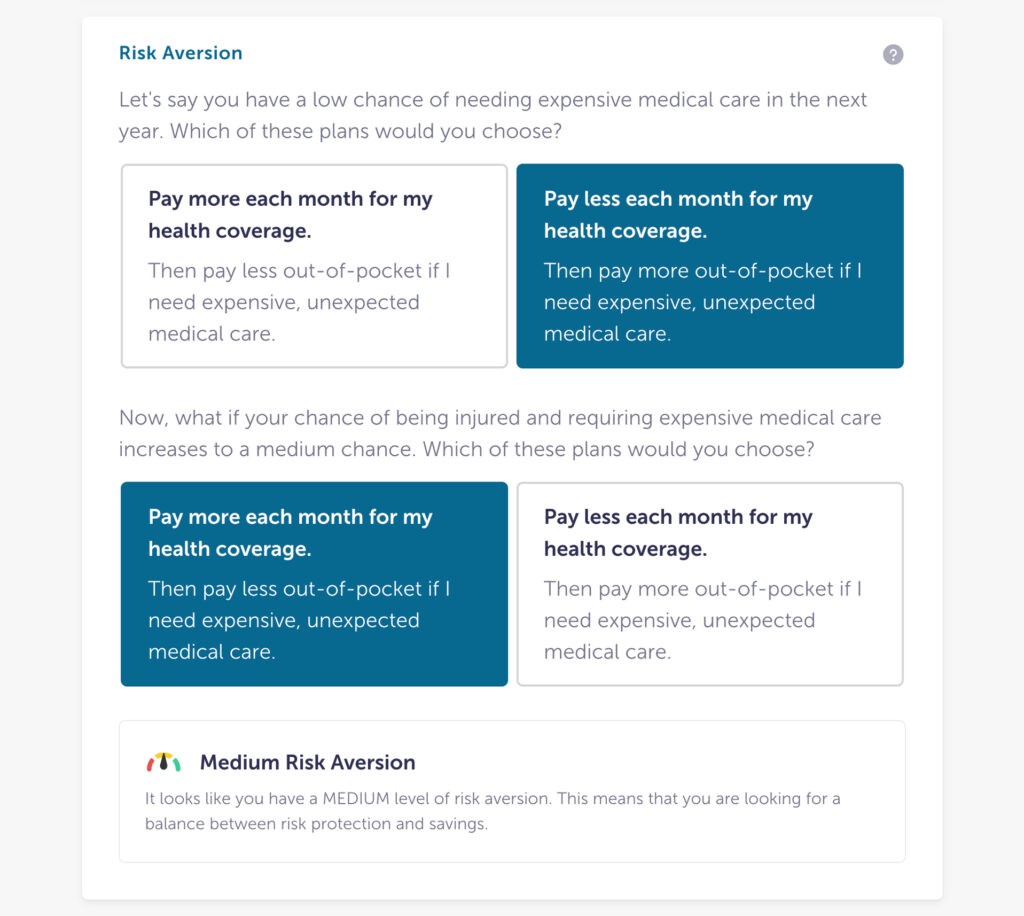

Employees have to weigh a lot of factors when deciding which benefits give them the best value. What healthcare will I need? What will it cost? How much risk am I willing to take on? What is this benefit, and how does it work? Everyone has to consider these questions when choosing health plans, and in the absence of decision support, most people make the wrong choice. They overestimate their risk and end up spending too much money. But this is where a benefits decision support tool (like ALEX) powered by predictive analytics can really shine.

By combining ALEX’s behavioral science expertise with Picwell’s predictive analytics software, we’re helping employees consider all of these factors and guiding them towards healthcare choices that will give them the right coverage at the right cost, based on their own preferences combined with data from people just like them.

ALEX Benefits Counselor and ALEX Go

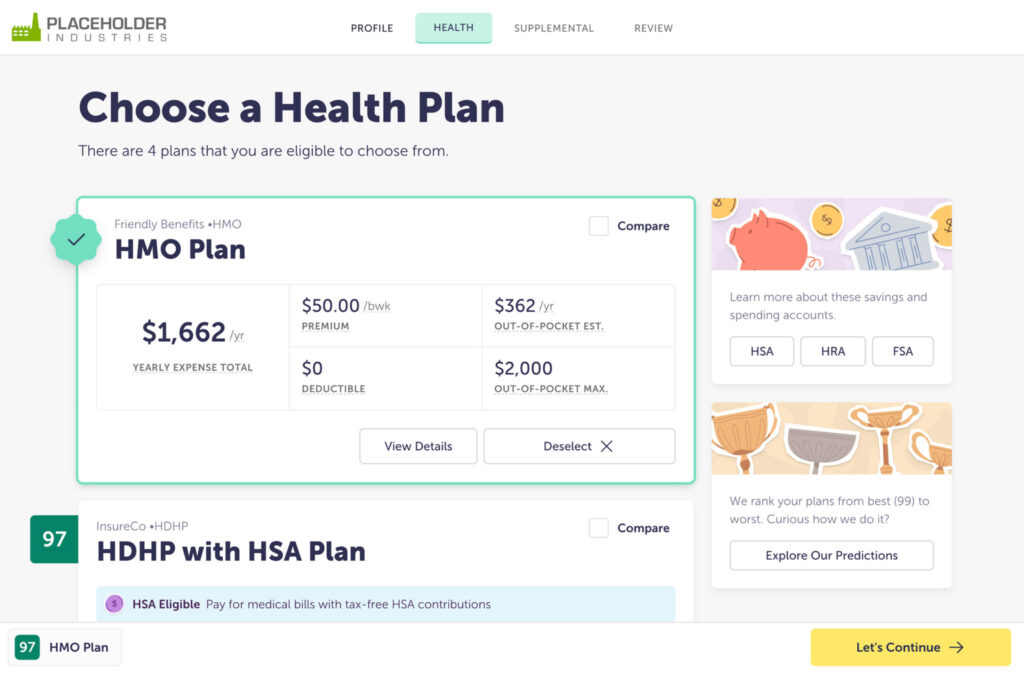

Now, ALEX uses predictive analytics to provide employees with cost and risk predictions for each medical plan option available to them, based on the actual healthcare utilization and behavioral patterns of people similar to them. Here’s how ALEX does it:

- ALEX analyzes anonymous claims data from people nationwide to see how they’ve used healthcare over the years.

- A one-on-one conversation happens between ALEX and an employee to understand their unique health status, personal preferences, and risk tolerance.

- With the help of machine learning, ALEX matches these personal variables against other groups of People Like You who share similar healthcare needs and risk factors.

- ALEX analyzes the data points from People Like You to predict the employee’s future healthcare use and costs—all based on the actual experiences of similar people.

- ALEX then uses behavioral economics to account for an employee’s financial risk and personal preferences.

- Finally, ALEX generates a Plan Score, which is a personalized metric that considers cost, risk protection, and preferences to help employees find the best value.

Harnessing the power of predictive analytics solutions for HR

We’ve come a long way, baby. Fifteen years ago, we never could’ve dreamed that technology would advance to the point where we could confidently predict what’s next. But the future is here, and it’s time to leverage the power of predictive analytics to drive the world of healthcare and benefits forward.

Because when we’re able to guide our employees towards the healthcare decisions that are right for them personally, it all adds up to a healthier, happier, more engaged workforce—and a better return on your organization’s benefits investment. Win-win! 🎉