Originally published 6/24/21, Updated on 5/3/24.

Ahhhh, the age-old standard of employee benefits resources: the benefits guide. For so long, we’ve basically been asking employees to figure out their benefits by sorting through a textbook. And that doesn’t work. Especially when you have five different generations of employees in the workforce who all have different communication preferences.

So, as you navigate embracing a multi-channel approach to benefits education, that meets employees where they are, here are nine ways to improve your open enrollment benefits guide this year:

1. Let’s Get Digital

First things first. If you’re still printing your benefits guide, it’s time to think about stopping. Not only is it a waste of paper, but it’s also a drain on your HR budget. And employees don’t want to read through a paper packet any more than you do.

So make your benefits guide a PDF or interactive landing page, and host it online where your employees can easily access it. It’s a more modern experience, and it’s way easier to search through. (Command+F is way more fun than using a table of contents, right?)

Yes, there are some fringe cases where you might need to print, like if your employees are hard-to-reach or don’t have a company email address. But even then, you have some way of getting ahold of them…via text, or with a poster in the break room, or by word of mouth through their managers. So there’s probably a way for you to share a link to your digital employee benefits guide, too.

Jellyvision Custom Solutions can help you create the perfect customized visuals to include in your digitized benefits guide!

2. Present the most urgent stuff first

Any reporter worth her salt knows an article should present the most newsworthy info first, supporting details second, and background information last. This is often known as “The Inverted Pyramid.”

Structure your benefits guide the same way. Put the most urgent, relevant information first, then work your way down—both when it comes to structuring the guide as a whole, and deciding how to organize information on a single page.

(For example, big benefits like health insurance, dental, and vision should come before short-term disability, which should come before voluntary benefits, and so on.)

Also, consider including a “What’s Changing This Year” section at the very beginning of your guide. Employees who just want to cut to the chase (aka most of them) will thank you. Probably not to your face. But in their minds, they’re definitely saying, “Thank you.”

3. Don’t be afraid to repeat yourself

In a world where we’re all just trying to remember where we put our phone, it’s hard to remember every detail of a benefits plan—or when we’re supposed to sign up for it. Don’t be shy about including the most important information in your guide multiple times, in multiple spots.

Here are a few things to say and say again:

- Important open enrollment period dates and deadlines. Mention them at least three times: in your introduction, your conclusion, and your “How to Enroll” page.

- Any changes to your benefits programs. You can include it on your “What’s New” page up top, but go ahead and include them again on the plan page, and anywhere else the information seems relevant.

- Benefits engagement tools. Do you use an interactive tool like ALEX? Mention it on your “How to Enroll” page. Then add reminders—and a URL—in call-outs on other pages related to the topics that tool covers.

4. Spread it out

Have you ever tried to save space and money by cramming a novel’s worth of content onto every page of your benefits guide? If so, stop doing that. A slightly longer, but much easier-to-digest finished product is always the better choice. As a general principle, limit yourself to one big idea per page. If that leaves a few pages with, say, half a page’s worth of white space, that’s fine (especially since you aren’t printing these anymore!)

5. Highlight real employee stories

If your benefits guide is chock-full of photos of generic business people living their best generic lives, we’d like to take this opportunity to stage a gentle intervention. Why?

Because your benefits guide is a huge opportunity to showcase how your benefits package actually helps real employees at your company. Include pictures of employees from company events (with permission). Share short stories throughout the guide about how your benefits package helped employees during different moments in their lives.

People are a lot more likely to engage during benefits enrollment when they can connect to the content. And if they see people they know in your guide, and hear real stories about how to use their benefits? They’ll be a lot more likely to pay attention to that than a stock image. And, make sure you’re including stories that cover all stages of an employee’s lifecycle (think about a first-time worker all the way to pre-retirement).

Guess what, we even have a guide to help with this: 10 Tips To Ask For Employee Testimonials That Promote Your Benefits Offerings!

6. Show the math (and the trade-offs)

Focus on cost transparency for each employee. Detail all of the costs an employee might incur when choosing a specific plan or making a healthcare decision.

It’s not just the math around the plan design. Employees need to understand how a plan might affect their cashflow, for example, if they need hospitalization or an unexpected x-ray or MRI. They need to understand which doctors are in-network, and what happens if they see someone outside that network. They need to understand how their health savings account can help them save for now and for the future. Help them evaluate each plan’s impact on them personally, given their unique health and financial status.

7. Visualize the savings (simply)

And while you’re thinking about how to break down the numbers, think about how you can simplify your visuals.

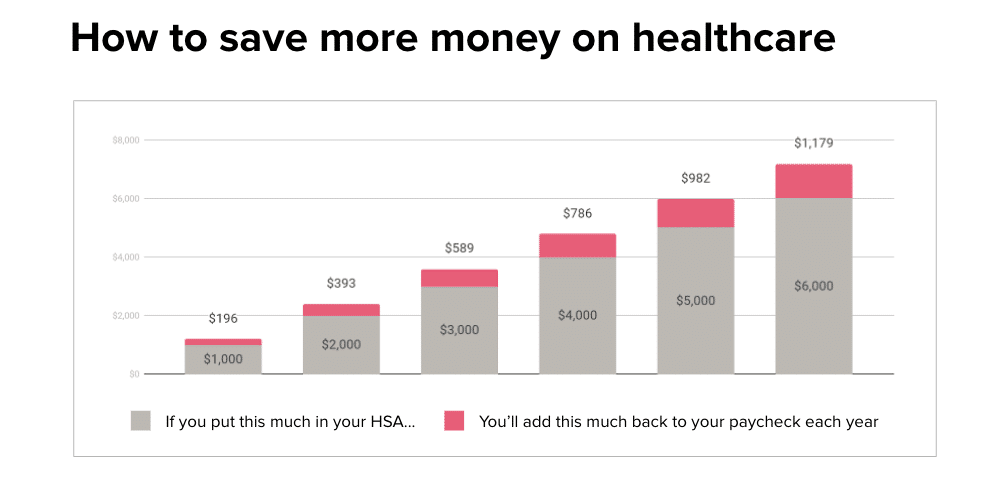

Here’s an example of a graph you could use to give employees a concrete idea of how much they could save if they contribute to their HSA. Here, they can clearly see: if you save $5,000 in your HSA, you’ll save almost $1,000 in taxes.

And while we’re here, take a minute to look at the language we’re using in this graph. We’re not using old jargon like “HSA contributions,” or “tax savings.”

To the average employee, tax savings are still pretty abstract, and might not be compelling enough to get them to save more. Instead, we’re using real, simple, human words that actually answer employees’ burning questions: “How can I put more money back in my own pocket?” “What’s in it for me if I decide to invest in an HSA?”

8. Personalize it

This is probably a common scenario for you: you just finished an hour-long benefits presentation, covering everything employees need to know about your benefits programs this year, complete with beautiful slides and a Q&A section. And inevitably, 20 employees come up to you at the end and say, “Yeah…but which plans should I enroll in?”

It can be incredibly frustrating, but it hits on an important point: employees only care about the benefits decisions that are best for their unique situation. So make your benefits guide personal. Outline several different scenarios, and which benefits plans might be the best choice.

For example, an HDHP is probably the right fit for a young, healthy employee who only goes to the doctor a couple times a year. But a married employee with two kids who seems to end up at the doctor’s office once a month? They’re probably best suited for a PPO or HMO.

Take your benefits communication from blah to bold with this course.

9. Make it a part of your larger strategy

As we mentioned at the beginning, your benefits guide is not a one-and-done kind of resource. It’s a great reference, but it’s only a part of your larger benefits communication strategy. To make a real impact, you need to meet employees on their turf. A multi-channel approach will help you get your message out multiple times, on the platform that each employee prefers.

Rather than asking employees to seek out your benefits guide and look up the answers they’re looking for, we need to intercept them in the moments that matter, and drive them towards the right benefits choices for them. Like when they’re adding money to their HSA, and aren’t sure how much they should be saving. Or when they’re filing a claim, and could be saving more with an in-network doctor. That’s when we can intervene, and proactively offer guidance. And unfortunately, your benefits guide can’t accomplish that goal alone.