You know what they say—the only certainties in life are death and taxes. But when it comes to actually understanding taxes and how they impact healthcare spending? Things get…well, a lot less certain.

Healthcare expenses are a significant burden for Americans, especially as they get older and need more medical attention. And Medicare is a valuable resource for aging folks as they look for ways to save. But how do taxes play a role in funding this government-sponsored healthcare option?

In this blog post, we’ll explore everything you should share with employees about Medicare and taxes, including how Medicare is funded, who pays for it, and how eligible folks can plan for Medicare-related expenses as they approach retirement.

What is Medicare tax?

Your payroll team is probably already an expert on what Medicare taxes are, but how do you explain it in easy terms to eligible enrollees?

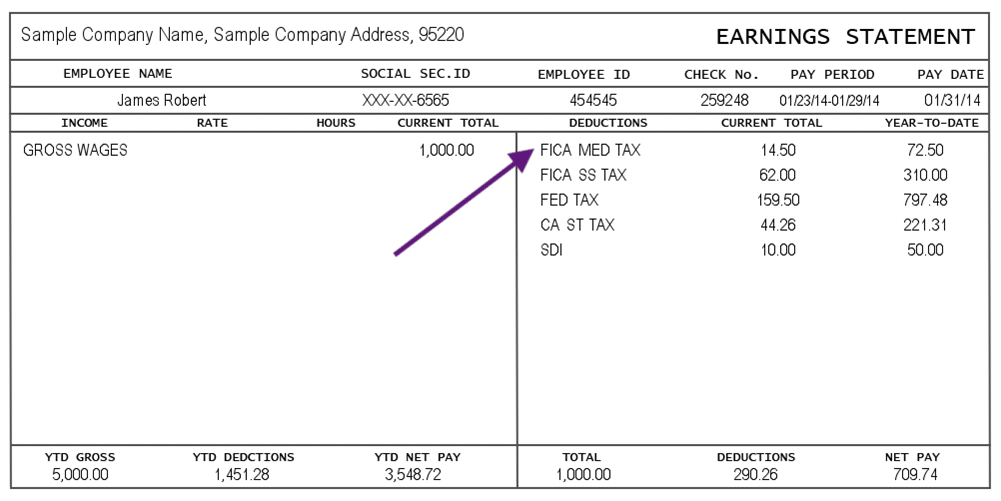

Simply put, Medicare tax is a payroll tax that’s withheld from employees’ wages. It’s part of the Federal Insurance Contributions Act (FICA) tax, which also includes Social Security taxes. If you’ve ever taken a look at your pay stubs, you’ve likely noticed it in the “Deductions” section:

The funds collected through this tax help finance the Medicare program, a government-sponsored plan that provides health insurance for individuals over 65 years of age, as well as those with select disabilities and health conditions.

How much is Medicare tax?

The Medicare tax rate in 2023 is 1.45% of all covered wages, with no income cap. That means all employees must pay this tax on all their wages, regardless of how much they earn.

Employers must also match their employees’ contributions, making the total Medicare tax rate 2.9%.

For example:

If an employee earns $50,000 per year, they and their employer will each pay $725 in Medicare tax, for a total of $1450 ($50,000 x 1.45% = $725 x 2 = $1450).

In addition, high-income earners are subject to an additional Medicare tax of 0.9%, bringing their total Medicare tax rate to 3.8%. This additional tax applies to employees who earn over $200,000 per year ($250,000 for married couples filing jointly) and self-employed individuals who earn over $200,000 in net self-employment income.

Are Medicare premiums tax-deductible?

Yes! Medicare premiums are tax-deductible under certain circumstances.

Suppose employees itemize their deductions on their federal income tax return. In that case, they may be able to deduct any Medicare premiums and other medical expenses that exceed 7.5% of their adjusted gross income (AGI).

For example:

If an employee’s AGI is $50,000, they can only deduct medical expenses that exceed $3,750 (7.5% of $50,000).

It’s important to note that only certain Medicare premiums are tax-deductible, including:

- Medicare Part A premiums (these premiums would be tax deductible)

- Medicare Part B premiums (which cover doctor’s visits and outpatient services)

- Medicare Part C premiums (which cover Medicare Advantage plans)

- Medicare Part D premiums (which cover prescription drug plans)

Employees should also know that only the premiums they and their spouses pay are tax-deductible. They can’t deduct any premiums their employer pays.

Employees should complete a Schedule A (Form 1040) to claim the deduction for Medicare premiums and include it with their tax returns. They should also keep in mind that if they take the standard deduction instead of itemizing, they won’t be able to deduct their Medicare premiums.

Do you automatically get Medicare with Social Security?

If an individual is eligible for Social Security benefits, they’ll automatically be enrolled in Medicare Part A and Part B when they turn 65 years old (unless they’ve already signed up for Medicare before then).

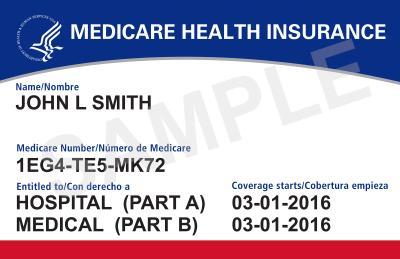

Beneficiaries will typically receive a Medicare card in the mail about three months before their 65th birthday. If they’d like to opt out of Medicare Part B for any reason, employees must contact the Social Security Administration to let them know. Otherwise, they’ll automatically be enrolled in both Medicare Part A and Part B and will be responsible for paying any associated monthly premiums.

If employees are interested in continuing to use your employer-sponsored health coverage, they may be able to delay enrolling in Medicare Part B without penalty. Ultimately, it depends on how their organization’s healthcare options pair with Medicare, so be sure to break down the specifics for employees.

Pro Tip: ALEX can help!

ALEX Medicare gets to know employees through a one-on-one conversation and helps them navigate the intricacies of Medicare (without burdening your team). Available via ALEX Benefits Counselor or ALEX Go, aging employees can access guidance wherever they are, on whatever device they’re most comfortable using.

Making sense of Medicare taxes

In short, understanding the ins and outs of Medicare taxes is essential for both employers and employees. Knowing how much is taken out of monthly paychecks, which Medicare premiums are tax-deductible, and when automatic enrollment in Medicare starts can help employees make informed decisions about their healthcare and finances.

It’s our job as benefits pros to stay up-to-date on changes to Medicare tax rates and regulations to support the aging workforce better. By educating yourself and employees, you can ensure that everyone is making the most of their healthcare benefits while also fulfilling their tax obligations.