Somewhere in your organization right now, an employee is putting off making an important benefits decision. Maybe they need to adjust their HSA contributions but aren’t sure about the right amount. Perhaps they’re wondering if their current healthcare plan still makes sense for their family. Or they might be a new hire, staring at their benefits options with glazed eyes.

It’s a scene that plays out in companies across the country every day. Despite your team’s best efforts to provide clear information and support, many employees find benefits decisions overwhelming, confusing, or just plain stressful.

The result? Delayed decisions, missed opportunities, and choices based on gut feeling rather than genuine understanding. And unfortunately, that leads to less-than-optimal outcomes that can cost both employers and employees significantly—through higher premiums, unused benefits, or missed savings opportunities.

That disconnect isn’t your fault, and it’s not your employees’ fault either. It’s simply how our brains work when faced with complex choices. That’s where behavioral science comes in, and it’s transforming how organizations approach benefits communication and decision-making.

What Is Behavioral Science in Benefits (and Why Should You Care)?

When it comes to benefits decisions, we’re asking employees to be fortune tellers, accountants, and healthcare experts all at once. That’s a lot to handle.

Instead of fighting against this overwhelming reality, what if we could work with the way people naturally make decisions? That’s exactly what behavioral science does.

It looks at how people really make decisions (not just how we think they should), and then uses those insights to guide them toward better choices. This means understanding the natural ways people process information and make choices, then structuring the experience to work with these natural tendencies rather than against them.

Let’s look at this from a benefits standpoint. Choosing benefits involves making a tradeoff between a lot of competing factors. Cost savings, risk protection, provider networks, plan quality…the list of things to consider go on and on. There are a lot of cognitive biases that go into the decision-making here, which leads to people ending up with too much (or too little) coverage.

Here’s where it gets exciting: when you use behavioral science to help correct some of those cognitive biases, it really pays off.

The familiar sound of “I’ll just keep what I had last year”? Then becomes “I think I found a better plan for my family.”

And for you and your team? Well, picture fewer last-minute panic emails and more confident decisions. Because when employees truly get their benefits (and we mean really get them), they’re more likely to choose plans that work for their real lives—not just the ones that seem the least confusing. All that translates to better matches between employee needs and selected plans, higher program participation, and a smoother, more efficient enrollment process for everyone involved.

ALEX Makes Behavioral Science Work for Your Team

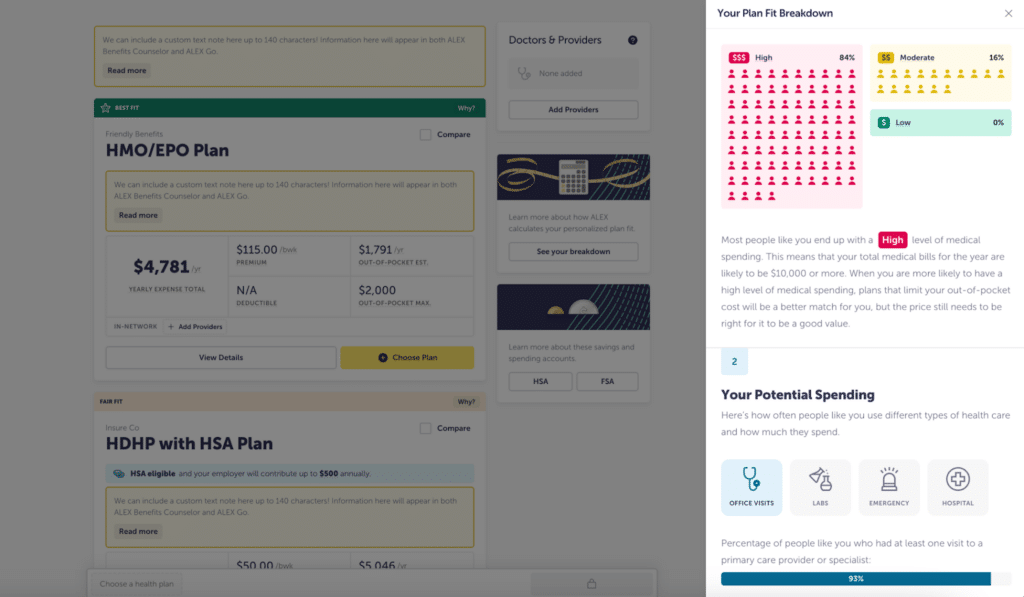

Think of ALEX as your guide to all things benefits. ALEX nudges employees towards smarter benefits decisions by using a blend of behavioral science, predictive analytics, and a sprinkle of humor. We’ll walk you through how ALEX uses behavioral science to model how different people think about the trade-offs between cost-savings and risk protection, helping employees make the best benefits decisions for themselves.

1. Create a Judgment-Free Zone

When employees feel judged or pressured, they’re less likely to ask questions or seek clarification. ALEX creates an environment where it’s okay to not be a benefits expert. By using everyday language instead of industry jargon, ALEX makes complex concepts accessible and easy to understand. The conversational approach, complete with well-timed moments of humor, helps employees feel like they’re chatting with a trusted, unbiased friend.

2. Personalize the Journey

Every employee brings their own unique circumstances to benefits decisions. ALEX recognizes these differences by asking targeted questions about individual situations and preferences, then uses that information to provide personalized recommendations. This tailored approach ensures that employees see information that’s relevant to their specific situation, making decisions feel more manageable and meaningful.

3. Break Down Decision Paralysis

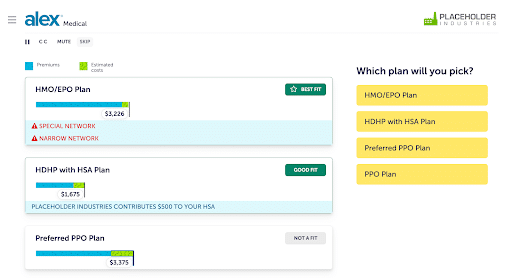

When faced with too many choices or too much information at once, many people freeze up or default to what they already know. What’s familiar is safe. ALEX prevents this by carefully structuring the decision-making process into manageable steps. Instead of presenting every plan option and feature simultaneously, ALEX guides employees through a logical sequence of choices that considers both cost savings and coverage needs.

Once ALEX understands your employees’ health needs, financial preferences, and risk tolerance, ALEX helps them find the sweet spot between premium costs and coverage levels. Side-by-side comparisons highlight key differences between plans and rate them Best, Good, Fair, or Not a Fit based on this balanced analysis. For instance, the lowest-cost plan isn’t always the best choice—ALEX helps employees understand that paying a bit more in premiums might actually lower their out-of-pocket medical costs in the long run through better coverage.

This approach of simplifying complicated products into a single dimension is backed by behavioral science and proven to improve decision-making and confidence in those decisions. In this case, this structure not only helps prevent decision paralysis but ensures employees find plans that truly match their unique situation.

4. Make It Easy to Take Action

Understanding benefits is only half the battle—employees also need to follow through on their decisions. ALEX removes barriers to action by providing clear guidance at every step. ALEX sends smart reminders about approaching deadlines, ensuring employees don’t miss critical enrollment windows. Plus, the ALEX ID feature allows employees to save their progress and return later, because important decisions sometimes need time and reflection.

Making the Shift to Smarter Benefits Communication

If you’re wondering how to leverage behavioral science to increase benefits engagement, the first step is to evaluate your current approach to benefits communication and identify where the challenges exist.

Consider the time your team spends explaining basic concepts, the questions that come up repeatedly, and the last-minute rushes during enrollment periods. Think about how many of your employees default to their previous selections without considering new options or changes in their situations.

Next, consider how a behavioral science-based solution like ALEX could address these specific challenges in your organization. Whether you’re dealing with low engagement rates, confusion about plan options, or simply trying to reduce the administrative burden on your team, ALEX’s approach can help create better outcomes for everyone involved.

Remember: When it comes to benefits decisions, having the right information is only the tip of the iceberg. How you present that information—and guide people through using it—makes all the difference.