Originally published 4/5/22, updated 10/2/23.

As organizations big and small strive to achieve greater diversity and inclusion, supporting an aging workforce becomes a critical goal for any benefits professional. With the Baby Boomer generation moving towards retirement, it’s essential to ensure that employees have access to resources that can help them navigate this new phase of life. That means it’s time to improve how we communicate with Medicare-eligible folks.

Educating beneficiaries early and often about Medicare will set them up for success—not to mention it’ll create a smoother transition to retirement.

That’s why we’re here. In this post, we’ll offer simple explanations for all things Medicare—from the different types to the current trends—so you can effectively communicate with your employees and clients.

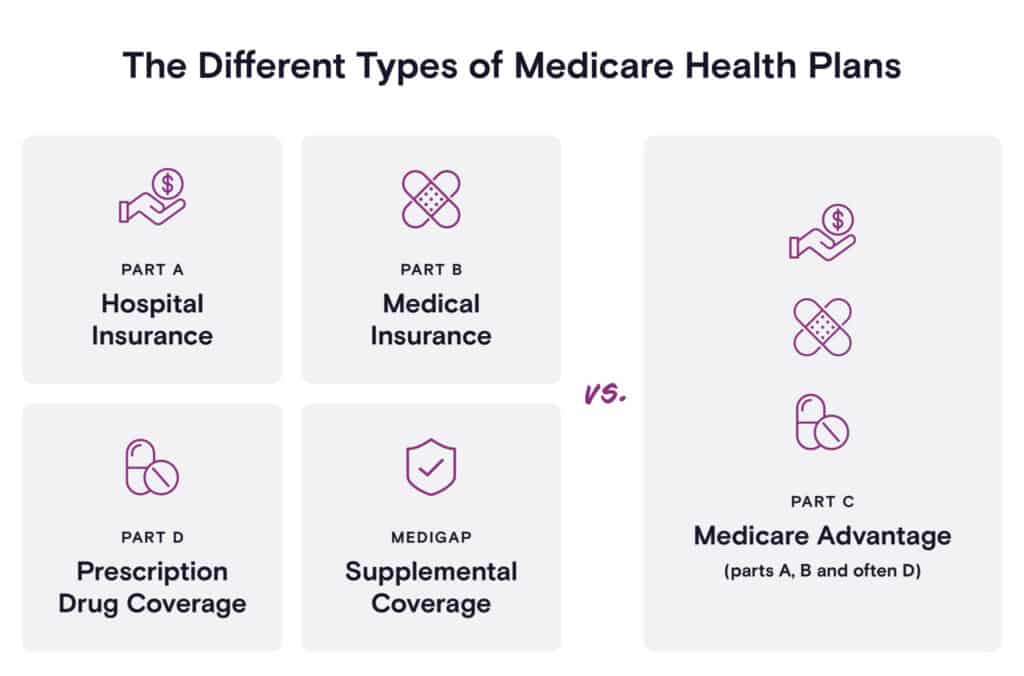

Understanding the different types of Medicare

Let’s start off with the basics. You likely already know the ins and outs of each type of Medicare, but your employees and clients are likely less familiar. So it’s important to begin by breaking down Parts A through D, so that folks understand what they’ll need to enroll in.

The most commonly known one is Original Medicare, a fee-for-service health plan consisting of Part A (Hospital Insurance) and Part B (Medical Insurance). Original Medicare works pretty similarly to health insurance. Beneficiaries can see any provider that accepts Medicare, then after they pay the deductible, Medicare covers its share of the amount (which is typically most of the cost, but not all).

Part A: Hospital Insurance

Covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home healthcare. There’s no monthly premium for Part A for most individuals.

Part B: Medical Insurance

Covers certain doctors’ services, outpatient care, medical supplies, and preventive services. There is a monthly premium for this coverage.

Medicare Part D: Prescription Drug Coverage

Users can choose to cover the cost of prescription drugs with Medicare, and that’s through Part D. This helps cover the cost of prescription drugs, including shots and vaccines.

To access Part D, beneficiaries can join a Medicare drug plan in addition to Original Medicare, or they can get it by joining a Medicare Advantage Plan—which is a topic we’ll get to shortly.

Medigap: Supplemental Coverage

If beneficiaries need help covering any remaining out-of-pocket costs, they can enroll in Medicare Supplemental Insurance, also referred to as Medigap. This helps eligible folks cover the costs of things like copayments, coinsurance, and deductibles.

At this point, your employees and clients might be wondering: why is there not a Part C? That’s very confusing. Good catch! There actually is a Part C, but it’s more commonly known as the Medicare Advantage Plan (see, we told you we would get to it soon).

Medicare Part C: Medicare Advantage Plan

Medicare Advantage Plans are offered through private companies and cover services from Medicare Parts A, B, and often D. These plans generally require enrollees to use providers who participate in the plan’s network and also set out-of-pocket limits. But they also tend to have lower out-of-pocket costs and may offer some extra benefits that Original Medicare doesn’t cover, such as vision, hearing, and dental services.

One benefit of the Medicare Advantage Plan is that users can choose from multiple plan types based on their needs and preferences. Below are the common types, with links to the Medicare website if your employees and clients are curious to learn more about each one:

- Health Maintenance Organization (HMO)

- Preferred Provider Organization (PPO)

- Private Fee-for-Service (PFFS) Plans

- Special Needs Plans (SNPs)

An overview of the Medicare landscape

Now that we’ve covered the basics of Medicare, let’s zoom out and look at the overall landscape. These trends can inform how you communicate with beneficiaries about Medicare.

Trend #1: Enrollment in Medicare Advantage plans is increasing

In 2022, over 28 million Medicare beneficiaries—about 46% of total Medicare enrollees—were enrolled in a Medicare Advantage plan.

And this growth isn’t anticipated to slow down any time soon. The Congressional Budget Office projects that the share of all Medicare beneficiaries enrolled in Medicare Advantage plans will rise to about 51% by 2030.

Why are we seeing this increase? A potential reason is due to the uptick in interest in holistic health. People recognize that there are additional benefits that come with Medicare Advantage plans, including access to vision and dental coverage, as well as support for their lifestyle needs—such as air conditioners for people with asthma and home-delivered meals for people who are immunocompromised.

Trend #2: Medicare and Medicaid are a major source of revenue for carriers

Revenue from Medicaid & Medicare plans grew from $92 billion in 2010 to $213.1 billion in 2016 for the top five insurance carriers—which include UnitedHealthcare, Anthem, Aetna, Cigna, and Humana. Put another way, these two programs account for 59% of the revenues of these carriers as of 2016.

With enrollment in Medicare and Medicaid continuing to expand—and given that the average gross margin per covered Medicare Advantage beneficiary is about double that of the individual or group market—these carriers will likely become increasingly dependent on the two programs for their growth.

This also means that “the big five” will probably continue to exit the Affordable Care Act (ACA) marketplaces in multiple states, adding to the fragmentation of insurance markets.

Trend #3: Medicare beneficiaries with employer-sponsored insurance is decreasing

Some people who continue to work past age 65 may have group health plan benefits through their employer, in addition to Medicare.

Unfortunately, it’s becoming less common for employees to have both. In fact, the proportion of Medicare beneficiaries with Employer-Sponsored Insurance (ESI) declined from 38% to 28% between 2010 to 2016.

This means that employees—especially those with low to middle incomes—may be facing financially burdensome Medicare premiums without additional assistance from their employers. If, as an organization, you can’t offer ESI to your retiring employees, the next best thing you can do is to educate and prepare them for future healthcare costs.

Start educating employees about Medicare today

Medicare is an intimidating topic, but it’s one that employees absolutely should become familiar with if they want to have a healthy, financially comfortable retirement. Fortunately, ALEX Medicare helps eligible folks navigate the vast sea of information in the Medicare world. ALEX Medicare provides a one-on-one conversation so that users can learn about Medicare eligibility and enrollment dates, coverage options, costs, and more!